Behälter KG Bremen retratada en la principal revista alimentaria alemana

En diciembre de 2024, Behälter KG fue retratada en la revista alemana de alimentación Lebensmittel-Zeitung. Se habló de nuestro papel como indicador temprano de la economía y del enfoque de sostenibilidad firmemente integrado en nuestro modelo empresarial.

Los clientes del sector alimentario han sido una parte esencial de nuestra base desde la fundación de la empresa, incluyendo la industria láctea, fabricantes de bebidas, postres, productos de aperitivo y muchos más.

Issue 50

December 13, 2024

Lebensmittel JOURNAL newspaper

Julian Beckh was 25 years old when he quit his job in the Mergers & Acquisitions division at the investment bank Goldman Sachs to, as he puts it, “establish himself as a corporate successor in Germany’s Mittelstand.” He is now in his eighth year as managing partner of Behälter KG in Bremen. Out of the fast-paced world of IPOs and spin-offs, and into the purchase, refurbishment, and resale of wine tanks, milk vessels, and chemical equipment.

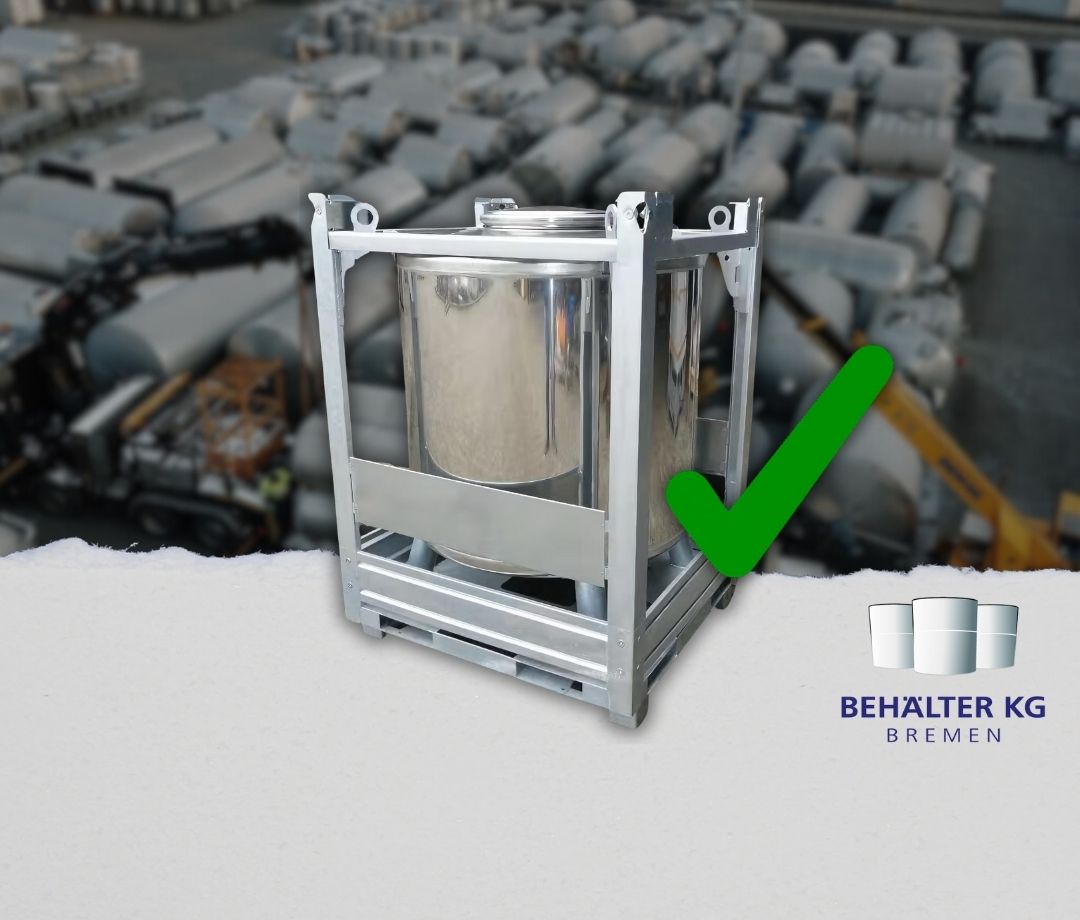

Beckh’s company specializes in the secondary market for all types of production vessels: “from the oversized ‘Coke can’ to the complex ‘Thermomix’ in industrial size — our range is vast,” he says. The main warehouse is in Bremen, from where Beckh, together with around 20 employees, generates more than 10 million euros in annual revenue. As a rule, Beckh buys from corporations and larger mid-sized companies in the German-speaking region and sells to the international Mittelstand and startups. At various locations he stores more than 2,500 tanks with volumes between 10 and 100,000 liters. When, for example, the dairy producer DMK closes a production site, Stute has to file for insolvency, or Henkel relocates production, Beckh is there. “We have to be in the right place at the right time,” he says. Competitors include companies like Eurolux, which bought beer tanks from Oettinger and primarily offer them on online platforms such as “Winzerservice.”

Beckh’s projects are diverse. For example, he says he took over an entire Henkel site for adhesive production from the Düsseldorf DAX-listed group and had all the apparatus dismantled for reuse. Today, the systems are in operation at startups and mid-sized adhesive and chemical companies.

Sometimes the business is curious: last year, for example, Beckh purchased the equipment of a decommissioned ice cream factory in Brandenburg. The site belonged to DMK. Because the company no longer had any use for it, Beckh can now call himself the proud owner of “Europe’s largest used ice cream production line.” Theoretically, it could produce 42,000 cactus-shaped popsicles per hour. The tanks and mixing tanks from the dissolved DMK production went to a local ice cream producer. Two industrial deep freezers, so-called freezers, were shipped to Australia. Beckh is currently negotiating over the cactus machines with potential buyers from the Middle East, Italy, and Nicaragua.

What makes Behälter KG so exciting from Beckh’s point of view? You can read the pulse of the German economy from his order situation, he says: “We are a leading economic indicator,” says the 32-year-old. It regularly happens that, within a year, he is offered tanks that come from multiple site closures within the same industry. Beckh is aware of sectoral upheavals before the public catches wind of them.

Demand from abroad: his business is booming. In the past, more and more companies have discovered the secondary market for themselves because the systems are quickly available, quality is respected abroad, and second use is considered sustainable. “Depending on the size and weight of a vessel, between 5 and 50 tons of CO₂ can be saved through reuse compared to new production,” says Beckh. Five tons of CO₂ are emitted in the production of one ton of stainless steel sheet, according to calculations by the Federal Ministry for Economic Affairs and Climate Action. That corresponds roughly to the emissions a truck produces when it drives from Berlin to Munich 34 times.

Right now, something else is on Julian Beckh’s mind. He has more supply than demand. “For the first time in 10 years, we have to be very disciplined in purchasing which vessels we buy,” he says. Due to the weak economy and a large number of insolvencies, more equipment is currently coming onto the market than can be sold — particularly in the dairy and wine industries. Demand in Germany is currently low. For Beckh, this means: “We are investing our budget primarily where we still have few comparable vessels in stock.” Fortunately, demand is higher elsewhere in Europe. In Germany as well, demand picked up significantly across industries in the fourth quarter.

“Our biggest competitor is scrapping,” says Beckh. Many customers are unaware that there are specialized dealers for used vessels and machinery. Yet the offer is attractive by comparison. Roughly speaking, the price for a ton of stainless steel scrap is currently 1,500 euros. Depending on the condition of the apparatus, Behälter KG pays 20 to 100 percent more for purchasing the vessels — and sometimes significantly more for very high-quality equipment. The value depends on the functionality of the vessels: “What’s interesting are units that are suitable for heating or cooling and that have an agitator,” he says. Beckh therefore prefers the industrial-size Thermomix to the oversized Coke-can-style tank.

Julian Beckh buys tanks and equipment when sites are shut down. With his Behälter KG, he sells them on the secondary market. He has never experienced so much supply as he does now. He sees in this an early indicator of the German economy. | Philip Brändlein

¿Desea obtener más información sobre este servicio?

Póngase en contacto con nosotros.